When it comes to saving, many people think they can only save those who have a lot of money and are quite loose financially.

Traveling was once, in fact, a thing of the rich. Nowadays with the boom of low–cost airlines and local lodgings, travel has become a banal thing.

Many people say they do not travel because they do not have money, and most of the time these people are surrounded by good houses, luxury cars and high-end mobile phones. True or not? At least for us, it is, and we have had this conversation several times with those who think we am rich because I travel a lot.

Most people actually want to travel more. But they have many other priorities before (house, car, insurance, family, work, etc.) and are not willing (yet) to make small compromises on those priorities that allow them to save. Please note that we am not against the priorities described above. In fact, these are the basic priorities that we all have, but there are strategies to get even more out of our budget.

This article is for you, that you have a monthly budget and you want to learn these strategies and start traveling more.

Save to Travel

First of all I want to mention that this article is not about saving tips, but strategies. We will not talk here about what you should eliminate from your life and that is not essential at first, as you can walk more, eat more often at home, stop smoking, sell what you no longer want, etc., because these tips are already common knowledge. We will try to make you understand how to manage your money so that you can save and travel more.

First you must create a savings plan. Analyze your monthly budget and evaluate what are the mandatory and optional expenses, to starting to get an idea of where you can start saving. That is, set priorities!

That said, what are some strategies that will allow you to save?

1 – Create a cash-flow

A cash flow is nothing less than the inflows and outflows of money. How many times have you heard people say“ I don't realize how I spend so much money?”

Not knowing where you spend your money is halfway so you can never save. We, for example, avoid using cards as much as possible, as we can't “see the money leaving our wallets” and easily lose control. We make weekly withdrawals of money and so we already have an idea of what we spend per week.

If you don't want to create a cash-flow on paper to point out all your expenses, you have lots of apps that do it, for example, the Cash Flow Manager.

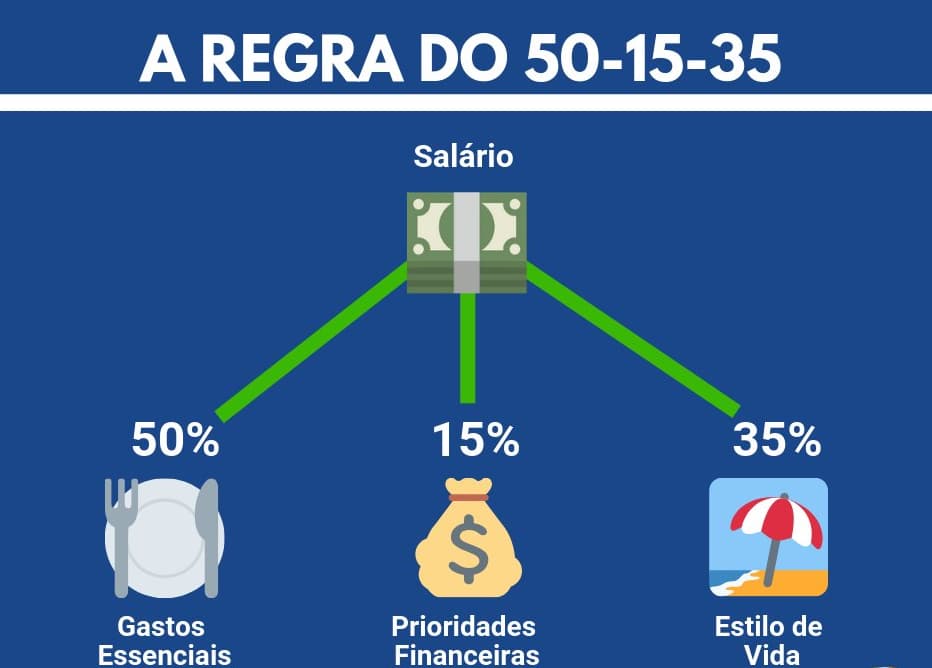

2 – Rule of 50-15-35

This rule is excellent. What does it say?

50% of your budget should go to yours essential expenses.That is, home and car monthly fees, insurance, food, health, education and everything else that is considered basic needs.

15% of your budget should go to your financial priorities.. That is, debt payments if there are any or make financial investments (PPR, Gold investments, shares, savings certificates, etc.). Or simply save that money as an Emergency Fund.

35% of the remaining budget for personal expenses.Here you can include everything like cinemas, dining out, gym, tobacco, alcohol, etc.

Now in these 35% percent you can still subdivide to create your travel fund,since traveling is a priority for you. Thus, you can withdraw a percentage of that 35% and save as “Travel Fund”. If you withdraw, for example, 10% to the travel fund, you get 25% for your personal expenses. You can open an account for your Travel Fund and ask your bank to withdraw 10% of your salary automatically, every month for that account.

3 – Get a second source of income.

2020 has taught us the importance of having a plan B.So it's never too late to create yours. Have a second source of income (even if it is small) is always good.. Do you like photography? Upload your photos in image banks and you can make money from it. You like knitting? Create a page in Facebook to sell your pieces. You like cosmetics? Why not be a reseller for Avon or company of this kind?

4 – Create a piggy bank

The famous cans or frames with travel themes help to gather some money. But sometimes they do not work for a number of reasons. So we have a new challenge for you, which was presented to me last year by Gonçalo Cruz. The easiest way to add 671 euros in one year! How easy? 1 Cent per day more than the day before, for a whole year.

Print these scheme and put it in your fridge. On the first day of the challenge you put 1 cent, on the second day 2 cents and so on until the last day of the year, where you will put 3 euros and 65 cents.

Are you ready to save and travel more and more?

See also our article How to save while on travel